McCulloch v. Maryland (1819)

Congress has Implied Powers to Create a National Bank

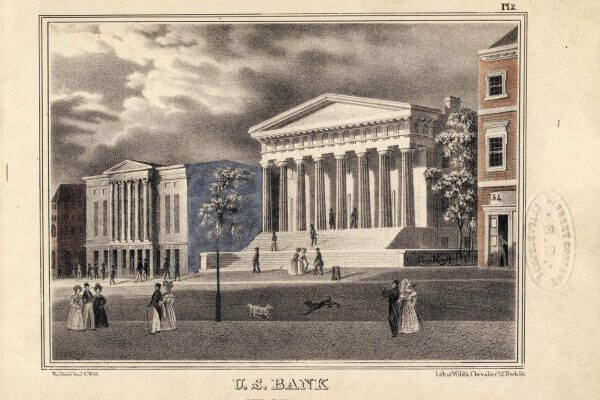

1804-1846 Lithograph of the United States Bank, also called the Second Bank of the United States (because it was the second federally authorized national bank).

Photo Credit: "Wild, J. C. , Circa Artist. United States Bank, Chestnut Street, Philadelphia. Philadelphia: Lithography of Wild & Chevalier. Photograph. Retrieved from the Library of Congress

Overview

The United States government created the first national bank for the country in 1791, but its charter lapsed under President Jefferson. During James Madison’s presidency, the Second Bank of the United States was chartered. The national bank was controversial due to competition with state banks, corruption, and the perception that the federal government was becoming too powerful. Maryland attempted to close the Baltimore branch of the national bank by passing a tax on all banks created outside of the state. James McCulloch, the bank’s manager, refused to pay the tax. The state of Maryland sued McCulloch saying that Maryland had the power to tax any business in its state and that the Constitution did not give Congress the power to create a national bank. McCulloch was convicted and fined, but he appealed the decision. The U.S. Supreme Court determined that Congress has implied powers that allow it to create a national bank, even though the Constitution does not explicitly state that power, and that Maryland’s taxing of its branches was unconstitutional because it interfered with the working of the federal government.

1804-1846 Lithograph of the United States Bank, also called the Second Bank of the United States (because it was the second federally authorized national bank).

Photo Credit: "Wild, J. C. , Circa Artist. United States Bank, Chestnut Street, Philadelphia. Philadelphia: Lithography of Wild & Chevalier. Photograph. Retrieved from the Library of Congress

"Although, among the enumerated powers of government, we do not find the word ‘bank’ or ‘incorporation,’ we find the great powers to lay and collect taxes; to borrow money; to regulate commerce; to declare and conduct a war; and to raise and support armies and navies . . . But it may with great reason be contended, that a government, entrusted with such ample powers . . . must also be entrusted with ample means for their execution. The power being given, it is the interest of the nation to facilitate its execution."

- Chief Justice John Marshall, speaking for a unanimous Court

Learning About McCulloch v. Maryland

Students

This section is for students. Use the links below to download classroom-ready .PDFs of case resources and activities.

About the Case

Full Case Summaries

A thorough summary of case facts, issues, relevant constitutional provisions/statutes/precedents, arguments for each side, decision, and case impact.

Case Background and Vocabulary

Important background information and related vocabulary terms.

Learning Activities

Teachers

Use the links below to access:

- student versions of the activities in .PDF and Word formats

- how to differentiate and adapt the materials

- how to scaffold the activities

- how to extend the activities

- technology suggestions

- answers to select activities

(Learn more about Street Law's commitment and approach to a quality curriculum.)

About the Case

- Full Case Summaries: A summary of case facts, issues, relevant constitutional provisions/statutes/precedents, arguments for each side, decision, and impact. Available at high school and middle school levels.

- Case Background: Background information at three reading levels.

- Case Vocabulary: Important related vocabulary terms at two reading levels.

- Diagram of How the Case Moved Through the Court System

- Case Summary Graphic Organizer

- Case Summary Graphic Organizer - Fillable

- Decision: A summary of the decision and key excerpts from the opinion(s)

Learning Activities

Teacher Resources

Teaching Strategies Used

Planning Time and Activities

If you have ONE day...

- Complete the Who Should Decide? Activity

- Complete the Classifying Arguments Activity. Discuss which arguments the students find most convincing. To simplify, complete the Anatomy of a Case Activity.

- For homework, have students read the Key Excerpts from the Opinion and answer the questions. Follow up the next day by reviewing the questions with students.

If you have TWO days...

- Complete the activities for the first day (excluding the homework).

- On the second day, complete the Judicial Opinion Writing Activity. For middle school classrooms, complete the Supreme Court Case Pack for Middle School Classrooms.

- For homework, have students read the Key Excerpts from the Opinion and answer the questions. Follow up the next day by reviewing the questions with students.

If you have THREE days...

- Complete the activities for the first and second days (including the homework).

- On the third day, complete the Federalism Activity.

- Complete the Implied Powers Activity.

- For homework: complete Chief Justice John Marshall’s Legacy.

If you have FOUR days...

- Complete the activities for the first and second days (including the homework).

- On the third day, complete the Federalism Activity.

- Complete the Implied Powers Activity.

- For homework: complete Chief Justice John Marshall’s Legacy.

Glossary

These are terms you will encounter during your study of McCulloch v. Maryland. View all Glossary terms here.

Related Cases

Legal Concepts

- These are legal concepts seen in McCulloch v. Maryland. Click a legal concept for an explanation and a list of other cases where it can be seen. View all Legal Concepts here.